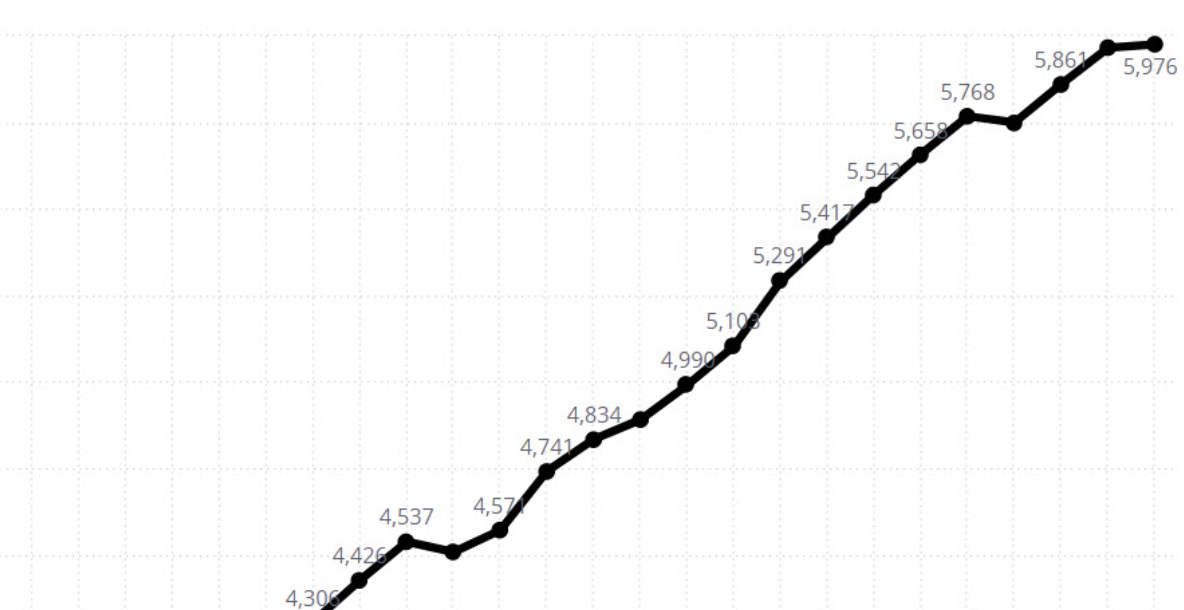

The glass is getting closer to being half full in business aviation. After a 70% drop in global private aviation in April, private jet flying is down by only 58% through the first 13 days of May. At its nadir, activity was down by around 80%.

The numbers compare favorably to the airlines. Global scheduled passenger flights were down 85% so far this month.

Separately, the cargo market is tracking “only” 20% between last year’s numbers. Publicly traded Air Partner recently pointed to cargo charters as helping offset the drop in private jet flights.

Over the past weeks, numerous industry executives have reported signs that private jets will help lead global travel recovery. Companies that already use private aviation are planning to expand their use.

At the same time, UHNWs who previously eschewed private jets are now turning to the segment, not for time savings or privacy, but health. One analysis shows potential COVID-19 exposure is 30 times lower when flying privately.

“Business aviation activity globally is still at least 50% below normal, but the trend this month is stronger than last month, and steadily recovering in all regions, in contrast to still-idle scheduled airline capacity,” says Richard Koe, managing director of WingX, which compiled the data in weekly Global Market Tracker.

Looking around the globe, the North American business aviation sector was down 58% month-to-date compared to 2019 levels. Flights in Asia were off 61% but improved on their 70% decline during April. Oceania was the most resilient region with private flights down by 34% so far this month. Flight activity in Europe was 66% below normal while Africa was off 54%.

All regions have seen some recovery in 7-day average daily activity through May 13, according to the WingX report. Overall, business aviation has increased its share of total fixed-wing activity to 35%. That’s up from 33% last week and 15% before the pandemic.

At a country level, the most resilient markets in May for business aviation have been Australia, Norway, Brazil, with flights down by around 30%, and Sweden, with flights down by under 20%. The UK, Italy, and Spain were still down 75% in private flights compared to 2019.

At the airport level, Palm Beach International Airport was the busiest in the world so far in May, with 608 sectors, down by 48%. Last year, it ranked seventh busiest in the U.S. Scottsdale was another resilient airport, flight activity down by 34%.

In Europe, Paris Le Bourget remains the busiest airport with private jet departures are down by 73%. Biggin Hill remained the busiest airport in the UK.

Long-range large-cabin private jet activity continued to be the hardest hit with 75% less than normal, according to WingX. Meanwhile, light jet and turboprops were at 50% of normal levels

Of course, the contents of business aviation’s glass are still a long way from spilling over the top. Koe said, “The green shoots are most obvious in the U.S., and still largely limited to light jet and turboprops.”

He added the expectation is, “The next phase of recovery will be the return of international traffic, which is still at very low levels.”