The new owner of XOJET is reportedly looking to acquire troubled flight sharing and charter broker JetSmarter.

A report in the New York Post yesterday picked up on industry rumors bouncing around the last couple weeks that JetSmarter would be sold to Vista Group, a Dubai-based holding company formed last September which was used as a vehicle to acquire XOJET weeks later. The report cited undisclosed sources claiming, “Both insiders identified roll-up artist Vista Global as the likely acquirer. But if talks between the two parties fail, and JetSmarter fails to secure additional financing, the sources said it could be forced into bankruptcy.”

A spokesperson for JetSmarter said there were significant inaccuracies in the Post story. The company added via a written statement, “JetSmarter is in stable financial condition and very much supported by its institutional investors. Recent reporting has contained false information about JetSmarter, and the company has clearly been the subject of a targeted and fabricated campaign. Our digital private and shared charter solutions are taking market share from all the largest players in the industry and causing some to engage in unethical competitive practices. We are excited about the future of JetSmarter and the value it brings to the industry.”

James Henderson, president of XOJET declined to comment when contacted by Private Jet Card Comparisons. The California based operator and charter broker has had an ongoing relationship with JetSmarter for several years, including an agreement that the sharing economy start-up would develop an app for XOJET’s customers, although that never came about.

As recently as last month JetSmarter CEO Sergey Petrossov identified XOJET as one of the charter operators his company is using to fulfill its full aircraft charters. XOJET has also been an ongoing provider of empty leg flights for JetSmarter members. Matteo Atti, an executive vice president with VistaJet said neither the operator or its holding company had any comment.

While in 2016 JetSmarter said it had achieved unicorn status, a privately held company with a value of more than a billion dollars, the Post estimated the sale price could be as little as $20 million. A person closed to the Ft. Lauderdale-based start-up acknowledged that conversations are taking place, but said, “Everyone in the industry knows there is there will be consolidation. There is a wide, wide gap between talking and making a deal.” He added that JetSmarter’s technology platform is “generating a lot of inbound calls.”

Its recent move to crowdsourcing flights where a set number of paid seats need to be sold before the flight is confirmed ostensibly would ensure it no longer is running flights at a loss. As a broker, its overhead would be limited to expenses like the staff, rent, technology, and marketing. Last year the company cut staff. With

The deal, if it comes to fruition may be worth it on several fronts. First of all, XOJET and Vista Group would acquire JetSmarter’s app technology which enables not only booking full aircraft charters but seat sharing flights, something many in the industry view as a future way to democratize the rarefied air of private jet flights. So far, the concept when applied against true private jets has not seen any meaningful success.

For XOJET and Vista Group, they would also inherit a database of 8,000 members, some of which are UHNW fliers who can afford full aircraft charters, which range from $5,000 to $20,000 per hour. Even just 100 members who spend $250,000 per year on charters would return $25 million, many that could be flown via the XOJET and VistaJet fleets. According to ARGUS, last year XOJET’s fleet of 43 Challenger 300 and Citation X private jet flew an average of 1,055 or just 20 hours per week. And while that number is top of the league when it comes to business aviation, commercial airlines fly over 70 hours per week meaning there could be an upside from higher fleet utilization.

With a combined fleet of nearly 120 super midsize, large cabin and ultra- long-haul jets that it owns, Vista Global would be in a unique position to make the by-the-seat model work, perhaps scheduling shared flights on days where there is low demand for full aircraft charter and on routes where seat sharing has shown some viability, such as New York to South Florida and within California and to Las Vegas where JetSuiteX has been expanding using reconfigured regional jets. Until recently, JetSmarter had used JetSuiteX as a provider for members when it converted to pay by the flight pricing structure.

The by the seat flights lack key benefits of full aircraft charter such as setting your own schedule, the flexibility to change your flight times and privacy, however, they do enable fliers to bypass commercial airline terminals, cutting total travel time by as much as 50% on shorter flights.

Of course, if Vista Global does acquire JetSmarter, it will have to decide how to handle the bad press it has been recently getting driven by at least a dozen lawsuits seeking millions of dollars by unhappy current and former members. JetSmarter was also recently the subject of a scathing report by CNBC, and we have closely reported on its troubles.

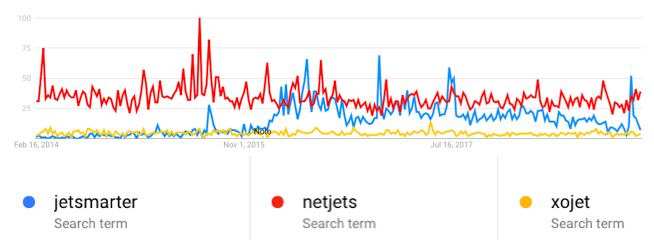

In keeping the JetSmarter name, XOJET and Vista Global will gain a brand that at points has challenged industry leader NetJets for interest and awareness, according to Google Trends. Until last year when XOJET introduced a light jet card membership program, its entry-level product was a super-midsize jet with a price of around $9,000 per hour. VistaJet plays in even more rarified air, with its jet card program requiring 50 hours of flying per years with rates starting at $12,000 per hour. On the other had driven by its founder and CEO Sergey Petrossov, JetSmarter began putting private jet flights within the reach of the affluent masses. At one point members who paid approximately $10,000 per year could reserve unlimited free seats on shared flights started by both the company and other members. They could also scan the app for empty leg repositioning flights, getting the entire aircraft for their use.

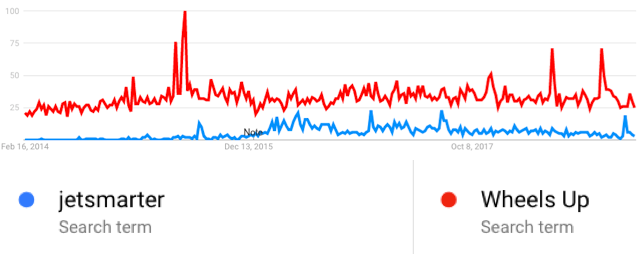

Other players to watch include Directional Aviation, which owns Flexjet, Sentient Jet, Skyjet and last year picked up U.K.-based charter broker PrivateFly. Wheels Up recently announced it had hired three investment firms to assist it with possible transactions. The company has made its focus democratization via its use of the King Air 350i where it can slice the cost to fly seven to eight people on short flights by as much as 40%. It also enables its members to share flights, splitting costs and today launched a new program, Wheels Up Connect. It’s priced at under $3,000 per year and largely built around flight sharing. Cash-rich companies from outside the industry from Uber to Google and Amazon have been mentioned as possible buyers who might want to get a foothold into the business aviation sector.