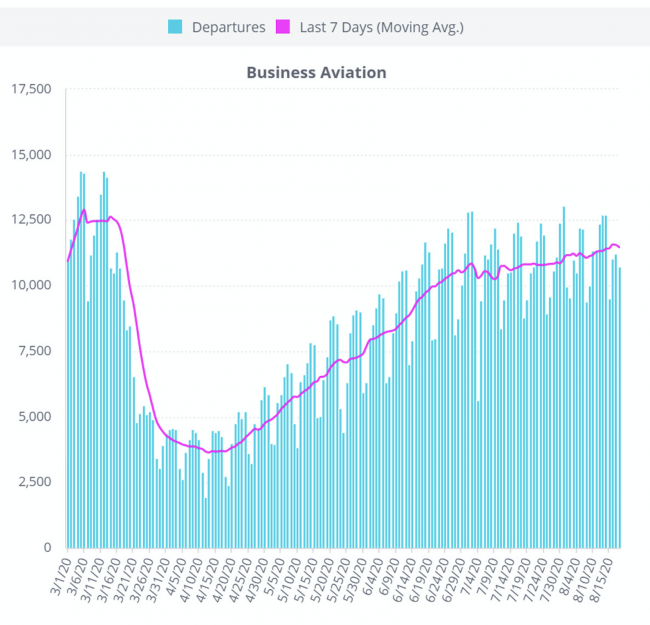

Worldwide business aviation activity reached its highest levels since the first weeks of March when flights plummeted.

According to the WingX, during the first half of August, global private aviation departures are tracking at 16% below 2020 levels.

Richard Koe, managing director of WingX noted, “The bounce-back in business aviation activity in Europe has been encouraging, even though it’s clearly a temporary boost coming from last-minute leisure demand as quarantines lift and switch, and the summer season winds up. The US recovery has been stunted, and the return of the business executive in the Fall is questionable with many corporations not requiring employees back at the office before mid-2021. That said, commercial airline capacity shows little sign of rebooting, and we still expect at least some shift from scheduled to on-demand services as the business traveler starts to need to fly again.”

Month-to-date sectors in Europe moved 2% ahead of the same period last year. Central and Eastern Europe, were less affected by renewed travel restrictions. Private jet and turboprop flights from Germany are up by 17% this month, Switzerland increased by 21%, while the Czech Republic, Poland, Ukraine all recorded at least 25% growth. Buoyed by holiday traffic, Croatia arrivals jumped almost 50%. A large share of flights is coming from Germany, which also has a spike in visitors holidaying to Switzerland, Austria, Belgium, Netherlands.

New COVID-19 virus concerns and restrictions are impacting Spain, however. Activity is down 8% so far in August, and 20% down from the peak of its recovery in mid-July. Barcelona, 22% behind for the month, managed to get to 90% of normal during the Grand Prix last weekend, WingX says. Mallorca meanwhile resisted downward forced and still posted a 10% increase in arrivals compared to the same period in 2019.

While U.K. private aviation arrivals are only 3% off 2019 levels, much of that was driven by Britons returning from France in advance of renewed restrictions. WingX said immediately after, flights dropped “acutely.” At the same, U.K. to Greece flights are up 80% in August.

The U.S., the world’s biggest private jet market, is now only seeing marginal recovery growth. After recording a 21% decline compared to 2019 numbers in July, August flights are tracking at 19% below year-over-year levels.

Remote destinations in Western U.S. states continue to be popular destinations. Colorado, Wyoming, Idaho, and Utah are seeing increases. Telluride arrivals are up by more than 90% and Aspen is 40% busier than normal. At the same time flights to Denver are down by 37% this month.

You can read our analysis of COVID-19 winners and losers on a country-by-country basis here.