Two AeroVanti members, who helped recruit other members, file a $19.75 million lawsuit.

In early 2022, William R. Morris III and William B. LeBanc III, after joining AeroVanti, cut a deal with founder and then-CEO Patrick Britton-Harr to bring more members to the upstart.

They and five LLCs where they are managing members, each representing an airplane AeroVanti was supposed to purchase, are now suing the troubled private jet membership club.

AeroVanti is behind on paying employees and vendors and has seen multiple airplanes repossessed, and now is facing a fourth lawsuit from customers.

The latest filing alleges “despite claiming to have over a dozen airworthy aircraft…Defendant AeroVanti likely only ever had one or two aircraft operating at a time.”

Morris and LeBlanc say a large portion of Defendant AeroVanti’s fleet is grounded due to maintenance and certification issues or repossession.

The latest lawsuit was filed in the Circuit Court for Montgomery County, Maryland, last week, withdrawn, but a lawyer for the Plaintiffs told Private Jet Card Comparisons the same complaint would be refiled Monday.

In last week’s action, Plaintiffs Morris and LeBlanc stated they “supported Defendant’s efforts to attract 100 new members signing on with AeroVanti to purchase pre-paid blocks of flight time hours.”

The lawsuit continues, “Approximately 60% of the new members were friends or acquaintances of Plaintiffs Morris and LeBlanc.”

The money collected from new members was to buy and refurbish additional Piaggio turboprop aircraft to expand AeroVanti’s fleet.

“In return for the help of Plaintiffs Morris and LeBlanc, Defendant Britton-Harr offered them stock warrants for 5% of Defendant Britton-Harr’s stock in AeroVanti, Inc.,” according to the filing.

READ: Caveat Emptor: Avoiding private jet scams, bankruptcies, and shutdowns

Morris and LeBlanc say they disclosed these warrants to the prospective members.

They say their payoff did not motivate their decision to introduce their friends and acquaintances to the flight provider.

Both surrendered their warrants back to the flight provider on May 26, 2023.

Now Morris and LeBlanc are suing as individuals and on behalf of the five LLCs where they serve as managing members.

The Plaintiffs want $14.75 million in actual damages and $5 million in punitive damages.

Named as defendants are Britton-Harr; Steven Leitness, an attorney for AeroVanti; AeroVanti, Inc.; AeroVanti Aviation, LLC; AeroVanti Yacht Club, LLC, and AeroVanti Holdings, LLC.

The transactions that are part of the lawsuit occurred between May 8, 2022, and Sept. 30, 2022.

In an email to other members reviewed by Private Jet Card Comparisons, Morris wrote, “The suit provides in pertinent part that Patrick Briton-Harr, with the help of his lawyer Steve Leitess, fraudulently induced 100 high net worth individuals into pre-purchasing flight time on AeroVanti aircraft. We were promised that our funds would be used by AeroVanti to purchase Piaggio aircraft, provide us service, and that the titles to the aircraft would be placed into escrow as security for our purchase. This was not done, as the aircraft were leased unilaterally by AeroVanti. Top Gun members would never have made their investment without this security. We are seeking actual damages to make LLC unit members whole and punitive damages for fraud. We would expect any damages recovered would be applied toward costs of the lawsuit, with the balance distributed to Top Gun unit holders of the LLCs.”

He added, “Bill LeBlanc and I are committed to tracking down the uses of our collective payment for flight time and persuading the court that punitive damages, although often difficult to recover, are appropriate in this case due to the egregiousness of the conduct. We do not purport to represent any individuals—only the LLCs of which we are the managing members.”

In total, LeBlanc and Morris helped sell $14.75 million in Top Gun memberships for AeroVanti over just five months last year.

According to the lawsuit, AeroVanti “made multiple representations that the block-time purchased by Plaintiff Morris, Plaintiff LeBlanc, and the other Unitholders would be secured by title (registration) to the purchased aircraft.”

That meant, “In the event of a breach by AeroVanti or AeroVanti Aviation, the title to the Piaggio aircraft, which was to be held in escrow, would be transferred to the limited liability company Plaintiffs as security for the money paid by the Unitholders. That way, the Unitholders would have an asset as collateral to secure their purchase and potentially recoup any losses arising from a breach.”

However, AeroVanti leased the aircraft instead.

READ: What happens to your jet card and private jet membership deposits?

While funds were held in escrow, the filing asserts, “In order to get the funds released from the escrow agent, the Defendants lied and made material misrepresentations regarding the status of the purchases and reconditioning of the aircraft.”

It asserts the money from LeBlanc, Morris, and their associates went to “personal use and other non-approved projects, including the possible purchase of two luxury yachts for AeroVanti’s other lifestyle offerings, brand marketing, and other projects, including but not limited to lavish sports sponsorships, such as the purchase of multiple chalets at the 2023 Preakness Stakes race.”

AeroVanti has signed private jet provider partnerships with the Tampa Bay Buccaneers, Chicago Cubs, University of Maryland, and recently U.S. Sailing.

Morris and LeBlanc each personally purchased $350,000 in block-time flight hours.

The duo first joined AeroVanti as members buying $200,000 of flight hours in Dec. 2021.

In Feb. 2022, they say Britton-Harr approached them with a proposal to buy a Piaggio turboprop and then lease it back to AeroVanti.

They rejected that offer, but they made Britton-Harr a counter proposal later that month.

They would bring to AeroVanti 100 people who would each purchase at least 100 block flight hours at a rate of $1,500 per flight hour.

AeroVanti would use the funds to buy and recondition to Part 135 standards five Piaggio P. 180 aircraft.

According to the lawsuit, the private jet membership provider never did purchase aircraft, instead entering lease/purchase agreements.

It also stated in Nov. 2022, a former employee anonymously emailed Top Gun members telling them their monies had been used to buy a yacht for start-up AeroVanti Yacht Club and “lifestyle offerings.”

The Plaintiffs added, “Further investigation revealed not only that AeroVanti had failed to purchase the aircraft, but that it was even in default of at least one of its lease agreements, and had been in default of that agreement since at least November of 2021. This was one of the aircraft that Defendant AeroVanti and Defendant Britton-Harr had represented was being purchased with the funds raised by the Top Gun Members.”

The lawsuit also alleges AeroVanti failed to maintain required insurance or enroll in stipulated maintenance programs.

Ultimately, the Plaintiffs say AeroVanti and Britton-Harr “had not purchased aircraft and had no intention to do so.”

So far, AeroVanti was hit with twin lawsuits in late May.

Another lawsuit was filed by a Top Gun member from Oklahoma last month.

On June 6, employees were told via email they could work from home or choose not to work as the company couldn’t make payroll.

Despite apparently never having more than a couple of airplanes in service, for a period last month, all AeroVanti’s aircraft were grounded, according to multiple sources, including a consultant.

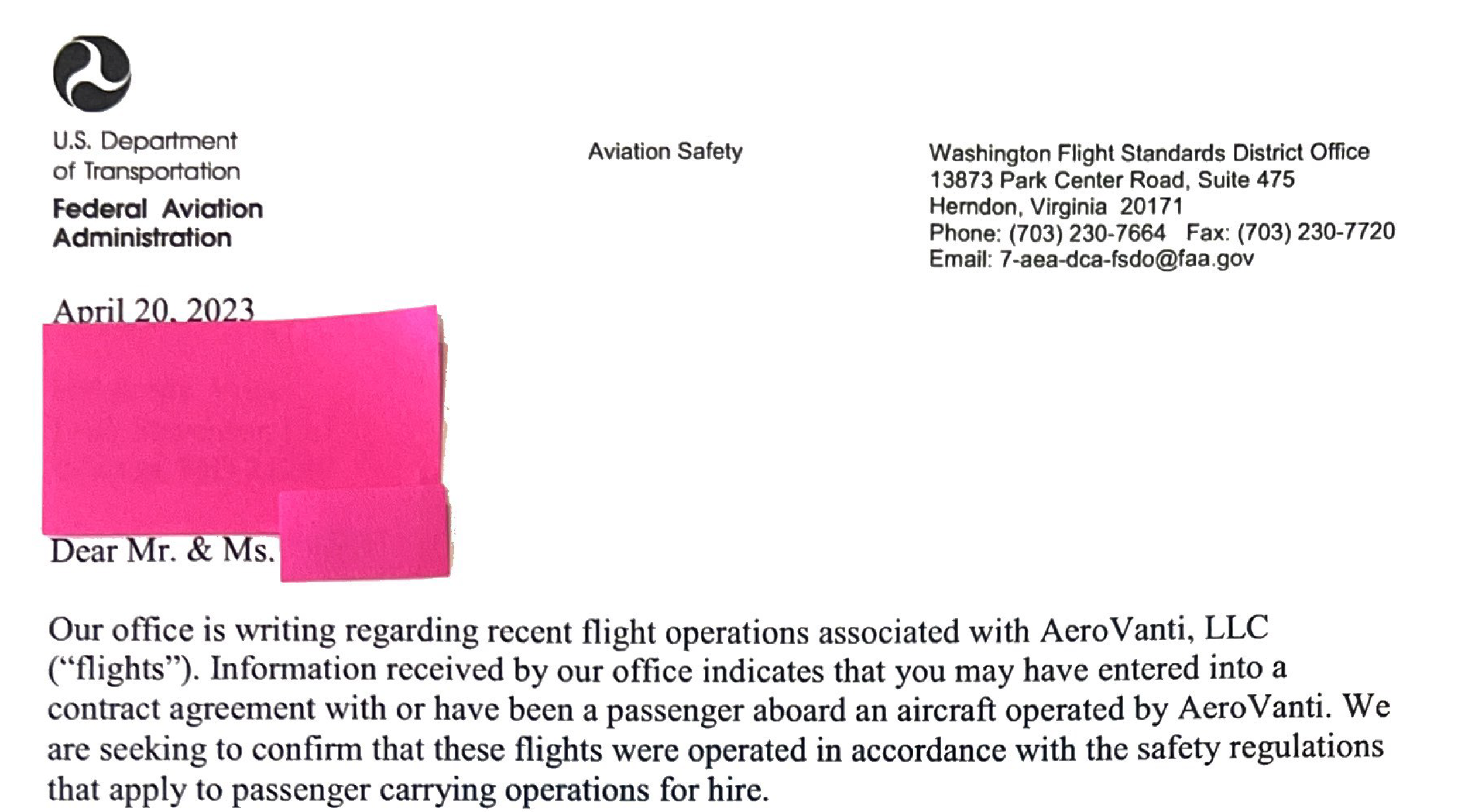

The flight provider is also the subject of a possible FAA investigation.

It flies under Part 91F instead of the typical Part 135 rules for charter and jet cards.

Sources say AeroVanti had as many as 400 members paying between $12,000 per year via pay-as-you-fly memberships to Top Gun memberships, which sold between $75,000 and $150,000.

Read the lawsuit William R. Morris III and William B. LeBanc III v. AeroVanti filed in Maryland, July 2023.