Headwinds for business aviation are expected to be even more fierce than predicted just last week. Back then, Argus TRAQPak predicted the private aviation flights in April would be between 40% and 60%.

In an update just released today, its analysts now expect a 67.3% decline this month.

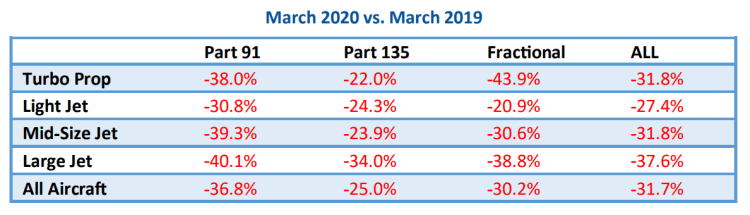

Argus also released its detailed overview of March, with numbers even grimmer than previously thought. The final analysis showed a 31.7% decline year-over-year.

Worst hit was Part 91 flying, which is owned aircraft flights. The category saw a 36.8% drop, with large-cabin jets sinking 40.1%. Light jet users fared best despite seeing flight activity fall by more than 30%.

Fractional operator activity was in line with the overall market, off 30.2%. Turboprop flights fell a stunning 43.9%. On the other end of the market, large-cabin private jet flights were down 38.8%. Light jet flying saw the least damage and was still off 20.9%.

A number of on-demand charter and jet card brokers were quoted in early March as saying their activity was booming. They credited evacuation and relocation flights. However, when the dust settled, there was plenty of red ink.

Part 135 did outperform the other segments, and it was still off 25% compared to 2019. Large private jet flights dropped 34% in March with turboprops (-22%), light jets (-24.3%), and midsize aircraft (-23.9%) all seeing declines in the low 20% range.

Overall, travel on weekends was off 28.1% compared to a decline on weekdays of 33.5%.

Argus noted in the report, “Business aviation’s agility will be crucial in recovery from historic declines.”

Perhaps a small sign of light at the end of the tunnel comes from this website.

Paid subscriptions for Private Jet Card Comparisons in April are tracking 20% ahead of 2019 on a year over year basis. That could indicate interest in jet memberships, perhaps to use as the stay-at-home orders are rescinded.

In March, subscriptions to our independent jet card buyer’s guide were up 15%. However, like the brokers, it was two months in one. Through March 15, paid subscriptions, which cost $250 per year, were up 100%. For the second have of the month they plummeted by 68%.

Many in the industry believe consumers who can afford to fly privately but had previously eschewed business aviation, may now switch as they seek to avoid exposure to COVID-19 in airports and on scheduled airline flights.

A study by one private jet operator found exposure to COVID-19 is 30 times lower for private travel compared to using the scheduled airlines.

A flash survey to Private Jet Card Comparisons subscribers in mid-March found 77% say reducing the risk of contracting Coronavirus will be a factor in choosing to fly privately over the next six months despite the economic downturn.

Waiver of the 7.5% Federal Excise Tax on domestic on-demand charter and jet card flights provide another incentive. While most jet card programs are passing along the savings, others have introduced new memberships that require lower deposits.