Sometimes, less change is better. That’s the thinking at Air Charter Service as it seeks to grow its U.S. jet card business.

It’s a significant move by a significant player. Air Charter Service is not a small broker with a nice website. The U.K.-based company generated over $1.18 billion in revenues during its latest financial year.

It has 27 offices globally, giving it a wide footprint with around 500 employees.

The sales record, according to company data, was driven by a surge in demand for cargo and large aircraft charters.

A large chunk was related to the Covid.

Documents filed at Company House in the U.K. show the company thinks sales may fall. They were around $700 million before the pandemic.

That may put the focus on its private jet business, less known but growing.

ACS now has North American offices in New York City, Uniondale, Long Island, Atlanta, Houston, Chicago, San Francisco, Miami, and Toronto. Plans call for more.

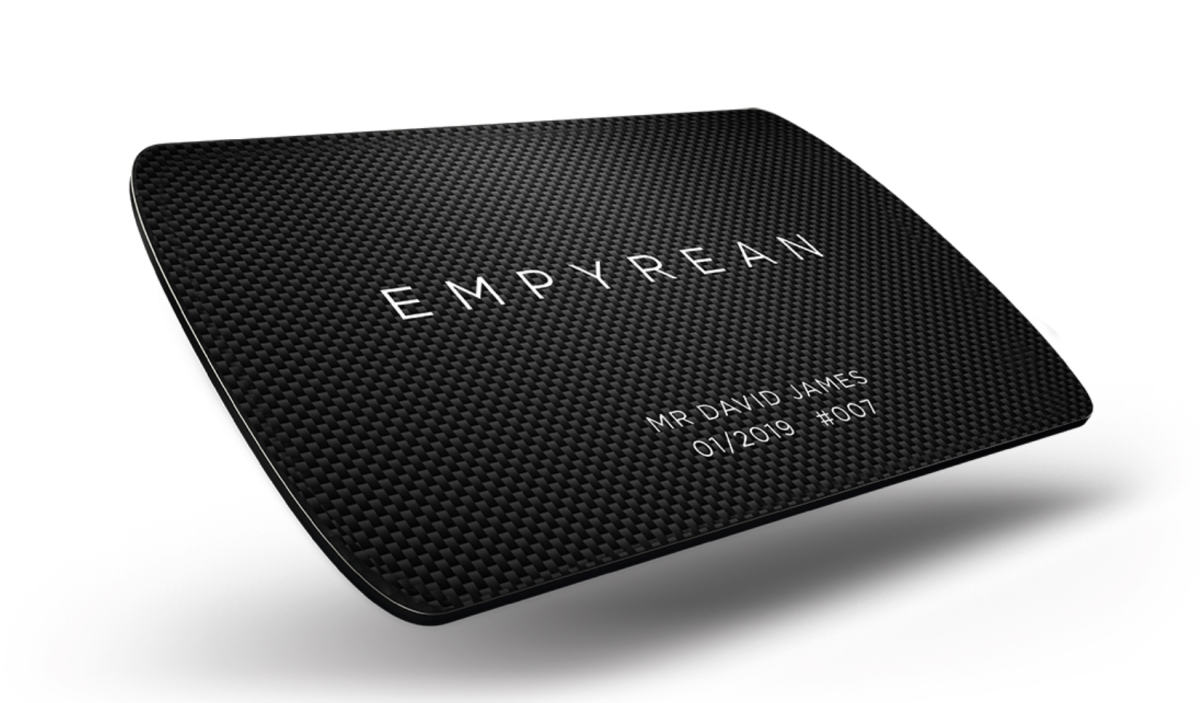

Part of the private jet charter growth is the expansion of its Empyrean Jet Card. Industry veteran John Castellano, who joined in June, plans to step up the promotion of the card program.

Empyrean has only been in the U.S. for three years.

This year, the card has seen a 55% increase in members and 100% revenue growth.

Castellano, the vice president of commercial sales, is an alum of Marquis Jet, NetJets, and Jet Aviation.

He believes ACS’s three product offerings, combined with a 360 degrees travel approach, can gain customers. Aiding the efforts is other providers making significant changes to their jet cards.

Part of the ACS formula is driven by an in-house travel agency and concierge service. That enables it to offer a full range of travel experiences, from ground transportation to hotels, dinner reservations, luxury villas.

It can even book tickets on the airlines, providing one-stop shopping. What’s more, clients can use their jet card deposits for the full range of services.

“We see the opportunity as wallet share of total travel spending,” Castellano says.

Air Charter Service jet cards

According to Webster, Empyrean means the highest heaven or heavenly sphere in ancient and medieval cosmology, usually consisting of fire or light or the true and ultimate heavenly paradise.

Air Charter Service offers three versions. There is the Empyrean Card comes in Market, Gold, and Platinum types.

Gold jet card

Gold is a capped rate jet card. Castellano makes a point of noting Air Charter Service introduced the product in 2018, before Wheels Up in 2019.

The capped rates – available with 72 hours’ notice – means if Air Charter can source your flights for less than the capped prices, you get the savings.

Recovery requires a requote, and while no blackouts on 39 peak days, pricing is dynamic. However, for users who are flexible, it provides light jet hourly rates from $6,250, including 7.5% Federal Excise Tax. That reflects an increase going into effect on Dec. 1, the first since the U.S. launch.

Platinum jet card

The Platinum Card is designed to be a broker’s version of a fractional jet card. It has a 24-hour lead time for non-peak bookings and allows cancelations up to 48 hours before departure.

For recovery flights, ACS will cover 115% of the cost.

Peak days where dynamic pricing applies have been reduced from 62 to 39 days.

For both the Gold and Platinum programs, the fixed and capped rate areas are the Continental U.S. and within 225 miles of the border.

Like other programs, you can choose from light, midsize, super-midsize, and large cabin.

Customers can use funds at capped rates for flights in Europe. It’s one of a limited number of cards to offer the feature.

Both start at 25 hours and are non-refundable.

Market jet card

The Market card is a dynamic pricing, refundable deposit account starting at $50,000. It essentially saves you the time and bank fees of wiring money for each charter.

It also gives ACS a viable option for private flyers traveling to areas where fixed or capped rates from the Gold and Platinum programs don’t apply.

At just 12 pages, the ACS jet card contracts are among the shortest, and Castellano says the philosophy is to offer an easy-to-understand program.

The ACS advantage

“We’re backed by a phenomenal company,” says Castellano.

The office network, supported by its diversified business, means ACS often provides departure and arrival meet and greets.

It’s something Castellano wants to expand, particularly with FBOs busier than ever and so many new flyers.

In terms of new clients for its jet cards, Castellano says in some cases they are already customers. There are untapped sales opportunities with executives who use ACS for cargo. At the same time, private jet clients are finding out that the company’s cargo division can support their business needs.

“In the jet card space, with more and more restrictions, jet card customers have gone to the end of the line. I hear and see their frustration. They are looking for something reliable at a competitive price point with customer service,” Castellano says.

To that end, he expects to grow his jet card sales team by 50% next year. “We’re hiring. We’re going to compete,” he says.