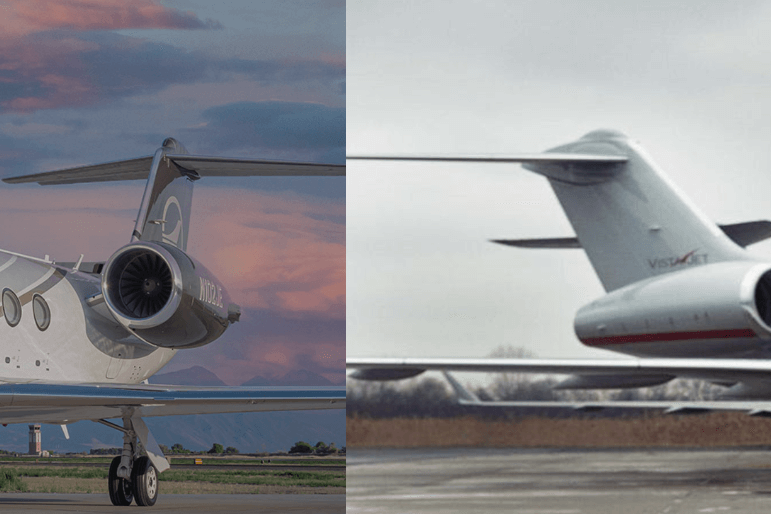

Vista Global is acquiring Jet Edge, the 8th largest operator in the U.S. measured by fractional and charter flight hours.

March 31, 2022

If you want a program-by-program comparison of more than 500 products from over 80 companies, covering 65 points of differentiation and over 40,000 data points, we have organized it all into a single, easy-to-use and compare spreadsheet.