Wheels Up for the first time reported quarterly results. They come ahead of its planned merger with SPAC Aspirational Consumer Lifestyle Corp. Once completed, Wheels Up will trade on the NYSE under the ticker symbol UP.

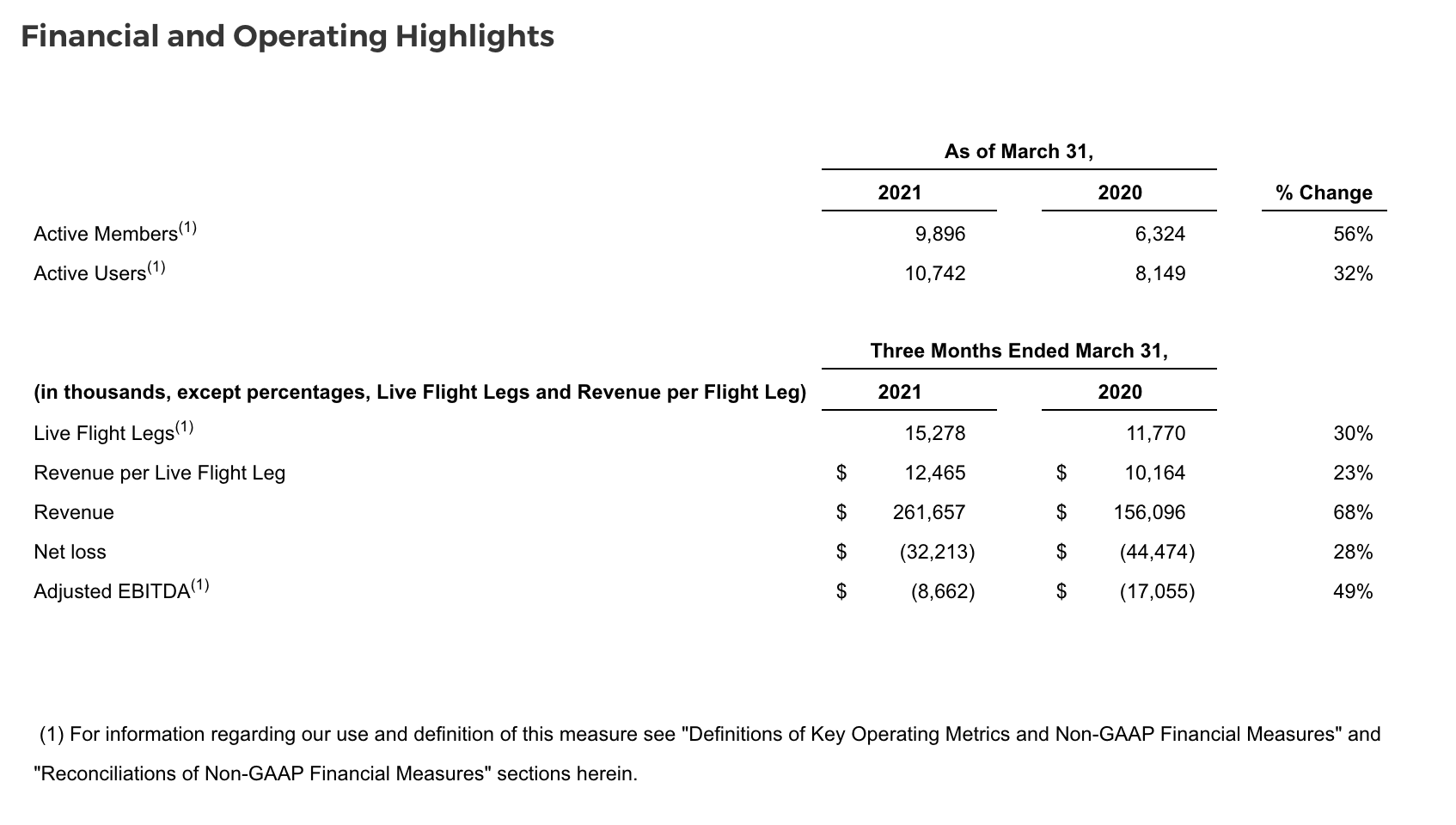

The results showed a significant gain year-over-year of active members (up 56%) and active users (up 32%). Live flight legs (up 30%), revenue per flight leg (up 23%), and revenue (up 68%) grew as well. At the same time, net loss declined 28% to $32.2 million. As a result, its loss on an EBITDA basis dropped from $17.1 million to $8.7 million.

“We started this year strong, with record revenue driven by increased flying from our significant membership growth, and contributions from recent acquisitions. Our customers are flying longer distances and across all fleet categories. It is clear they continue to see the value in our trusted brand, reputation for exceptional service, expanded fleet offerings, and our Wheels Down experiences. We are thankful to the entire Wheels Up team for their hard work and dedication in delivering for our members and customers during this meaningful growth period,” said Kenny Dichter, Founder & CEO in a release announcing the results.

The revenue increase to $261.7 million from $156.1 million year-over-year was attributed to a combination of factors. In addition to “strong flight demand,” last year, Wheels Up acquired Delta Private Jets on Jan. 17 and Gama Aviation LLC on March 2. This year it added Mountain Aviation on January 5.

The increase to 9,896 active members came by retaining existing members and “continued success converting” Delta Private Jets jet card members. Despite being among the 10 largest U.S. charter operators, neither Gama nor Mountain had jet cards or membership programs.

Other highlights include:

Discounted transcontinental pricing launched because of its Mountain Aviation acquisition “generated significant new demand and revenue.”

Non-members gained access to its booking app. It allows them to look for and book flights with guaranteed pricing.

New tools and technology to improve fleet scheduling and utilization and provide new reservation capabilities were deployed. There were also new reporting capabilities to augment customer care.

Wheels Up continued its talent acquisition shopping spree by adding top executives from Amazon, Airbnb, Adobe, Hilton Hotels, and GE Capital, overseeing its digital marketplace, legal, and HR.

The release stated, “Management continues to successfully execute on its strategic plan to create a marketplace for private aviation, increasing the addressable market while enhancing member and customer experience and optimizing operations and fleet utilization. Investing in our brand, recruiting strong management, and developing transformational technology are at the core of our marketplace strategy.”

The announced merger with Aspirational Consumer Lifestyle Corp. (NYSE: ASPL) is expected to close near the end of the second quarter of 2021.

.