As jet card sellers cope with sourcing flights at guaranteed rates on short notice and system hiccups against record demand, Sentient Jet plans to temporarily halt sales at midnight tonight.

CEO Andrew Collins confirmed the move. “We want to have our 100% focus on existing customers,” he tells Private Jet Card Comparisons.

As we reported here first, NetJets and its aircraft management arm Executive Jet Management both announced similar temporary stops last month. NetJets has created a waitlist, guaranteeing existing pricing when it resumes selling cards.

At the time Jets.com, a midsized broker, also announced it was temporarily halting jet card sales. However, it relaunched its program with longer call-outs, more peak days, and higher rates earlier this week.

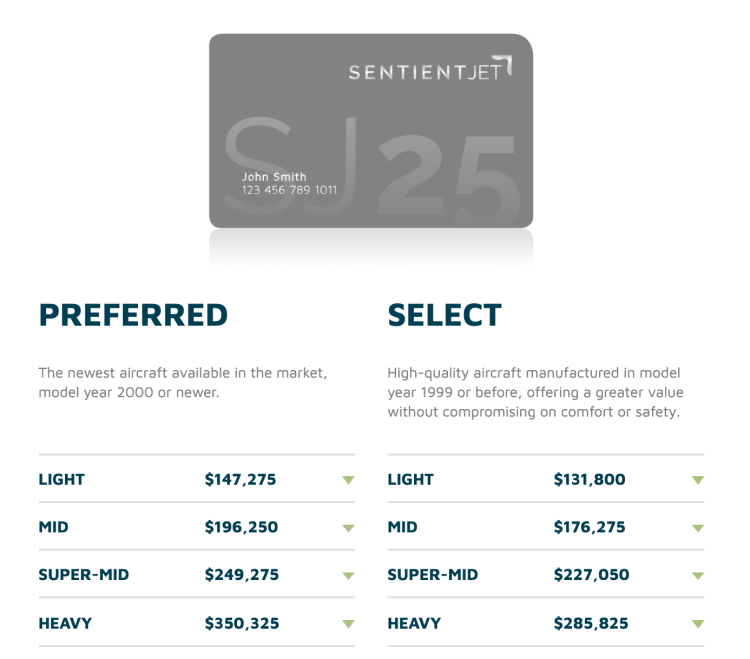

Earlier this month, Sentient had increased non-peak call-out from 10 to 24 hours and increased rates. Collins says Sentient will allow current customers with low balances to renew during the pause on new customers.

While Sentient isn’t setting a firm date for when it will again begin accepting new customers – it will review the policy in 90 days – Collins says his sales team is continuing discussions with prospects who are looking to fly beginning in 2021.

Sentient in its latest moves had kept its 60-minute taxi-time inclusive daily minimums on both light and midsize jets. The majority of jet card programs have daily minimums on light and midsize jets ranging from 90 to 120 minutes.

Collins says any future changes will be made with a focus on keeping its program as customer-centric as possible.

Record demand is putting pressure on jet card programs that offer fixed or capped pricing with guaranteed availability.

In many cases, those rates are guaranteed for 12 months or longer. In some cases, the notice period to book flights at the contracted pricing was 24 hours or less.

Consumers who have seen on-demand charter quotes spiking in recent months have been flocking to jet cards with fixed rates.

Collins says the “opportunity cost” of the pause could mean losing as many as 500 to 600 new clients. However, he says providing the best possible service to current customers is the company’s full priority.

Last year, Sentient tallied $450 million in jet card sales, so a 90-day hold means during a typically busy sales period means it could be eschewing well over $100 million in new deposits.

However, the sellers have to be able to profitably source those flights on short notice more often than not. When there are mechanical or other issues, many programs guarantee no-cost replacement aircraft, adding to the cost burden of jet card sellers.

Several industry executives have expressed concern that for the holidays, there could be a shortage of jets when customers come en masse to book. Executives have been urging customers to book as far in advance as possible and avoid peak days.

Velocity Jets, a boutique broker in Florida, said earlier this summer it had stopped taking new customers. Despite the pauses, there are over 50 providers actively selling card and membership programs.