Multiple sources tell Private Jet Card Comparisons both Vista Global Holding and Flexjet, Sentient Jet parent Directional Aviation have been in discussions to acquire Jet Edge, the seventh-largest Part 135 charter operator in the U.S., in what would be the heated industry’s latest deal.

On February 3, rival Wheels Up made its fifth operator acquisition since June 2019, buying Alante Air Charter. Last month, it announced a deal to acquire U.K.-broker Air Partner.

Since its September 2018 acquisition of XOJet, Dubai-based Vista Global Holding has added Red Wing Aviation and Talon Air. It also acquired brokers Jet Smarter and Apollo Jets.

Earlier in January, Private Jet Services Group parent Elevate Holdings snapped up Keystone Aviation, saying it would be “the first of many.”

Directional has made several small acquisitions of broker and fixed-wing operators in Europe. It also bought two helicopter operators and ordered 200 eVTOLs as part of a last-mile strategy. It continues expanding its jet fleet organically, ramping up with new aircraft deliveries for its Flexjet unit.

Jet Edge itself has been making deals. It bought Jet Select in January 2020 and has been funding expansion via KKR.

Vista will own stakes in four of the 17 largest U.S. private jet charter operators if it wins the deal.

According to just-released North American data from Argus TraqPak, XOJet last year ranked third by flight hours behind Wheels Up and NetJets’ charter arm, Executive Jet Management.

Jet Edge was ranked seventh, having moved up two spots on 68% growth of flight hours.

Red Wing Aviation was ranked 11th, while Talon Air placed 17th.

Collectively, Vista operators were already in the second spot with 79,223 hours. Jet Edge’s 32,403 hours would move Vista Global closer to Wheels Up at 166,805.

Read: 25 Biggest Charter Operators in 2021 Ranked and 2021’s Largest Fractional Operators Ranked

Still, NetJets and EJM flew a combined 541,125 hours last year, three times more than second-place Flexjet. Directional Aviation’s fractional operator clocked 178,053 hours on North American departures, according to Argus.

Jet Edge has been in the news frequently since last June when it announced a $150 million line of credit from KKR.

Last month it said additional investments from KKR had reached $265 million.

After adding 27 super mid and large-cabin jets last year, Jet Edge said it would use the extra monies to add 20 more jets by midyear. Its resulting fleet size would then grow to 95 aircraft.

Last Fall, Jet Edge announced it had generated over $100 million in deposits for its new Reserve jet card program. More recently, it expanded its fixed-rate pricing, and it also revealed plans to add guaranteed availability.

One source said Jet Edge is looking for as much as $1 billion in an acquisition.

A deal would grow Vista and Directional’s fleets to around 300 aircraft.

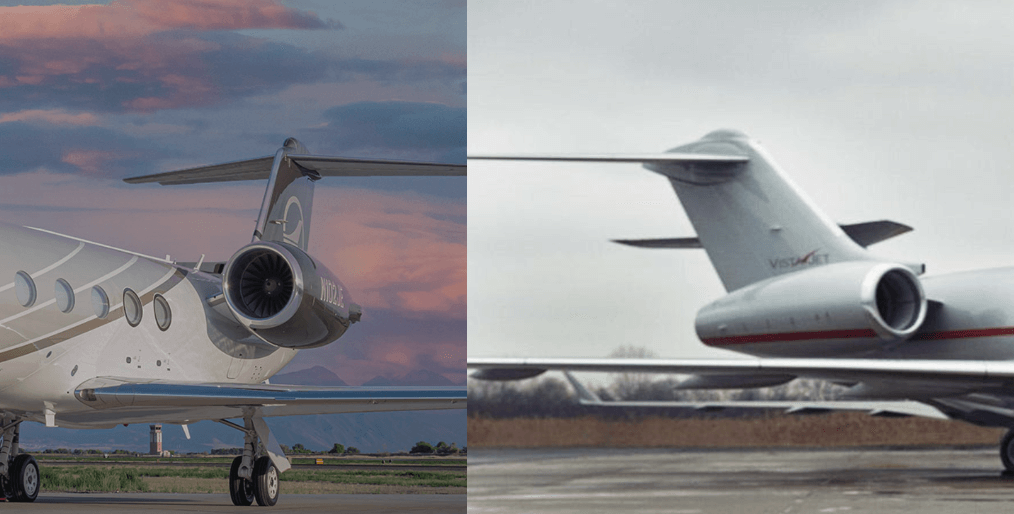

That includes 23 new Global 7500s and Challenger 350s Vista is adding for its VistaJet unit. It has been buying and refurbishing used light and midsize jets to grow the Red Wing fleet. Prior to acquiring XOJet three-and-a-half years ago, Vista had around 70 aircraft, mainly in Europe and Asia. Jet Edge’s fleet is exclusively U.S.-based.

In addition to increasing its position in private aviation’s biggest market, the deal would make Vista Global an even bigger force in direct-to-consumer business. It could also impact smaller charter brokers.

After being bought by Vista and Wheels Up, independent brokers say fleets of the acquired operators were prioritized for the jet card and membership customers of their new parents.

“It could certainly change some relationships,” said one insider. “It will be more difficult for smaller brokers in terms of their regular clients who have specific requests and aren’t flexible.”

For Flexjet, it is taking deliveries of new jets from Embraer and Gulfstream, including the ultra-long-range G650ER. Its fleet growth strategy includes keeping jets retired from the Flexjet fractional fleet and using them for customers of its brokerage units. In the past, it would have sold those jets.

In 2020, Directional’s broker Sentient Jet reported $450 million in jet card sales. Broker Apollo, before being acquired by Vista last year, had a reported $250 million in sales. That helped boost Vista’s 2021 revenues by $700 million to $1.6 billion, according to Moody’s. It also means both need airplanes to fulfill customer flight requests.

It’s possible talks will not proceed beyond current discussions. Sources say they have been ongoing since the Fall, and an announcement is not necessarily imminent.

“(Jet Edge CEO) Bill (Papariella) is holding the cards,” said one source.

Despite record demand, OEMs are staying disciplined with production.

While fleet operators like Vista and Flexjet have options for new jet deliveries, they are typically capped for specific time periods. For manufacturers that depend on the operator orders, newfound demand from individual buyers provides an opportunity to diversify the customer base.

“The used market inventory is at a record low. There are a fixed number of new aircraft. If your business model is driven by growth, Jet Edge is a plug-and-play answer,” said one person, adding, “Jet Edge doesn’t need a deal. They are already a key player in the super-midsize and large-cabin market. They could opt to go it alone.”

Money isn’t an issue for potential buyers. Last month Vista added to its coffers as it completed a bond offering that was more than five times oversubscribed, according to the company.

One big question is how Jet Edge would be integrated. After acquiring XOJet, Vista chairman Thomas Flohr split its sales, marketing, and technology, combining them with JetSmarter into a new broker platform XO Global.

Since buying Talon Air, Vista rebranded its management under XO. However, it has left broker Apollo Jets operating under its own name.

Directional’s OneSky unit, which includes Flexjet, Sentient Jet, FXAir, PrivateFly, and Halo, is arranged by customer segments. Flexjet focuses on fractional shares, and broker Sentient is the jet card brand. Brokerages FXAir and PrivateFly target on-demand charters, and Halo is a vertical lift operator.

Spokespersons for Jet Edge and KKR declined to comment. A representative of Vista Global said, “We prefer not to comment on rumors.”

A spokesperson for Directional denied the report, saying, “There is no truth to the rumor. We have no interest in acquiring Jet Edge.”

Last year Bloomberg reported Vista was discussing a public listing via a SPAC merger, although the deal never happened.

One thing seems assured. There is no apparent let-up in consumer demand for private jets. A current survey of Private Jet Card Comparisons’ subscribers found in the next 12 months, 52% plan to fly privately more than last year, with 43% saying flying will be at similar levels. Only 5% will be flying the private skies less than 2021.

Recently Flohr said there had been a “paradigm shift in the global client’s view of private aviation.” He predicted “thriving” demand to continue for 12 to 18 months.

Last year, both Sentient Jet and Flexjet stopped taking new jet card customers to align demand with available supply as did other major players, including NetJets, EJM, and Jet Linx Aviation.

One person put it this way. “Demand is not an issue. Everyone can use more supply. He who has the jets makes the rules.”