Delta Air Lines is providing Wheels Up a short-term capital infusion; Wheels Up is selling its private jet management business to Airshare.

Wheels Up Experience postponed its Q2 earnings release this morning and instead announced Delta Air Lines is making a short-term capital investment. It also entered a non-binding letter of intent to sell its private jet management business to Airshare, the 9th largest U.S. charter/fractional operator. In 2022, Wheels Up ranked third, behind NetJets and Flexjet.

“Wheels Up Experience Inc. is actively involved in discussions around strategic business partnerships for the company and today announced that Delta Air Lines has provided a short-term capital infusion to the company,” according to a release issued by the New York-based private aviation provider.

The company, after accumulating losses and decreasing cash, said in its last earnings call it planned to dispose of non-core assets, something CFO and Interim CEO Todd Smith repeated during a presentation in June.

Twice since May, Wheels Up has had to address bankruptcy reports.

However, it seemingly has the backing of Delta Air Lines, which owns 20% of the company, and its CEO, Ed Bastian.

During a speech in May, Bastian said, “The relationship is strong. I think (Founder and now Board Member) Kenny [Dichter] has done a masterful job over the last decade building a high-quality brand, great experience, (with) a lot of new members, and for us to be able to add that to our stack is the premium opportunity within the Delta experience, well no one has ever been able to do that before, and we have been attempting to pull that off.”

Update at (Aug. 9, 2023, at 9:55 am): In a 10-k filing first reported by Reuters, Wheels Up stated, “On August 8, 2023, the Company entered into a short-term capital infusion in the form of a secured promissory note with Delta Air Lines, Inc. These efforts have involved significant resources and have been a priority for management, thereby diverting significant management time and internal resources from the Company’s processes to review and complete its financial statements and related disclosures in a manner that would permit a timely filing of the Form 10-Q. For this reason, the Company will be unable, without unreasonable effort or expense, to complete and file the Form10-Q within the prescribed time period. The potential investments and/or capital raise described above are subject to market and other conditions that are not within the Company’s control. Absent the ability of the Company to obtain this additional funding in the near-term, the Company has concluded that there is substantial doubt about its ability to continue as a going concern for any meaningful period of time after the filing of this Form 12b-25. The Company is endeavoring to complete its financial close process and file its Form 10-Q on or before Monday, August 14, 2023, which is within the five calendar day extension provided by Rule 12b-25.”

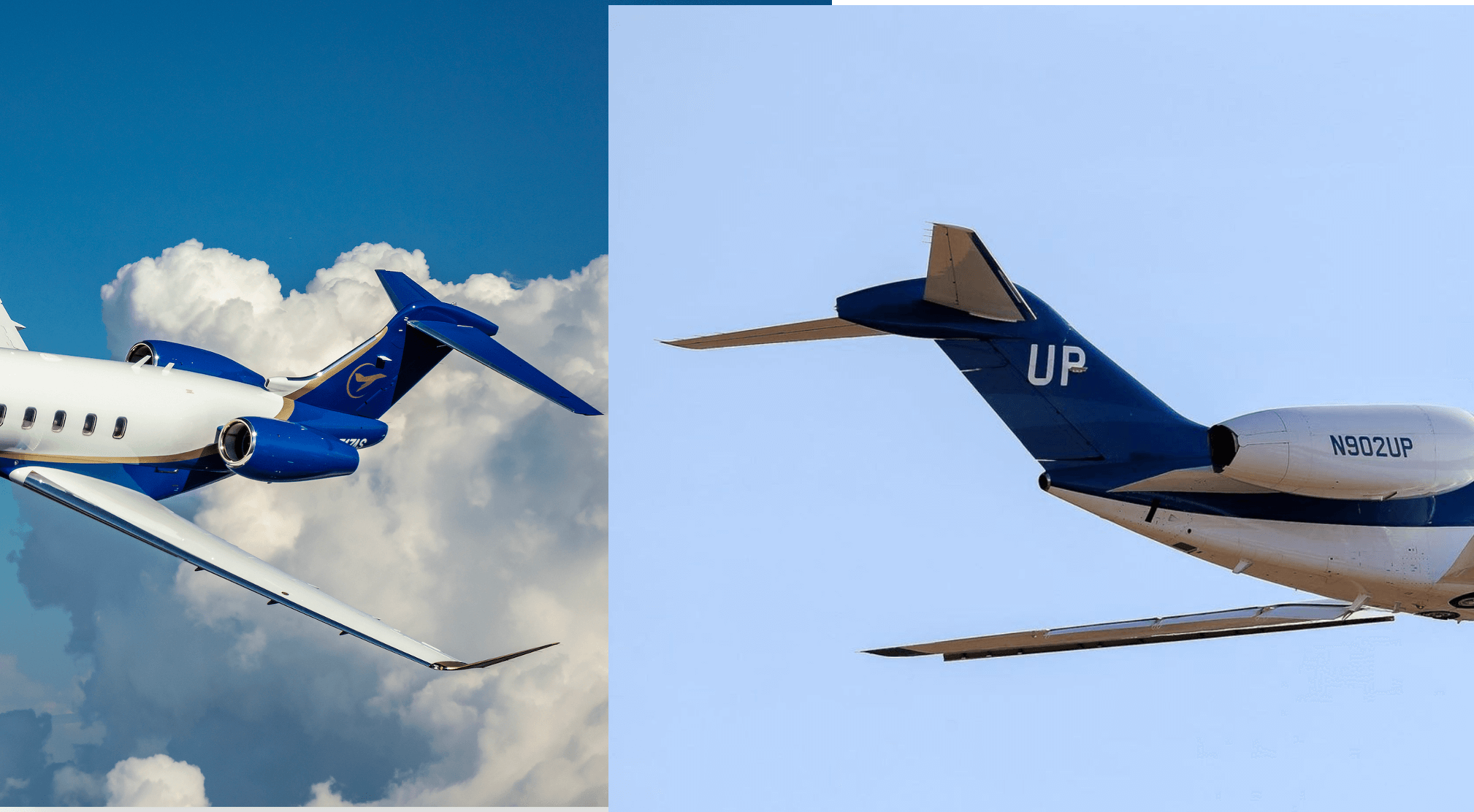

Airshare was recently in the news with an additional order for Challenger 3500 super-midsize jets for its fractional program, which also features the Phenom 300.

Airshare currently has 58 aircraft between its owned and managed fleet, and the acquisition of Wheels Up’s management business should double to triple its total fleet.

It also recently expanded its primary service area to Florida.

“Our management team has worked diligently to establish a strong foundation for us to intelligently grow the company, and this potential acquisition is a direct result of those efforts,” said John Owen, President and CEO of Airshare.

He added, “Aircraft management has become a core source of revenue for Airshare. Adding aircraft capacity and valuable owner relationships to our rapidly expanding managed fleet positions us very well for the future.”

A spokesperson for Airshare tells Private Jet Card Comparisons that jet card and fractional customers of the Overland Park, Kansas-based company will now have broader charter options when their program aircraft type doesn’t fit their mission.

Additionally, the aircraft owners currently managed by Wheels Up will benefit from the non-program, supplemental demand Airshare has from its fractional and jet card customers.

Even with the sale of its management business, Wheels Up would likely have a fleet of around 150 owned or leased aircraft with a heavy concentration of King Air 350s and Citation Xs.

A spokesperson for Wheels Up says there are no changes to customer programs.

He declined to comment on which operator certificates are part of the transaction.

READ/DOWNLOAD: Updated list of all Part 135 charter operators and aircraft

The deal is expected to close in the third quarter, subject to customary approvals and closing conditions.