Aerovanti’s website went offline again last week. In January, a Maryland Federal Court judge found its founder and CEO, Patrick Britton-Harr, had violated a court order not to sell a home he jointly owned. Now, Bloomberg Businessweek has gone behind the scenes at the jet card program, which is facing multiple lawsuits.

The report will read more as a recap of what members and employees already know.

It traces how Britton-Harr gained hundreds of members by offering “a steal compared with the industry.”

Members paid $1,000 per month at the start with the promise of flights for $1,500 per hour, well below market rates.

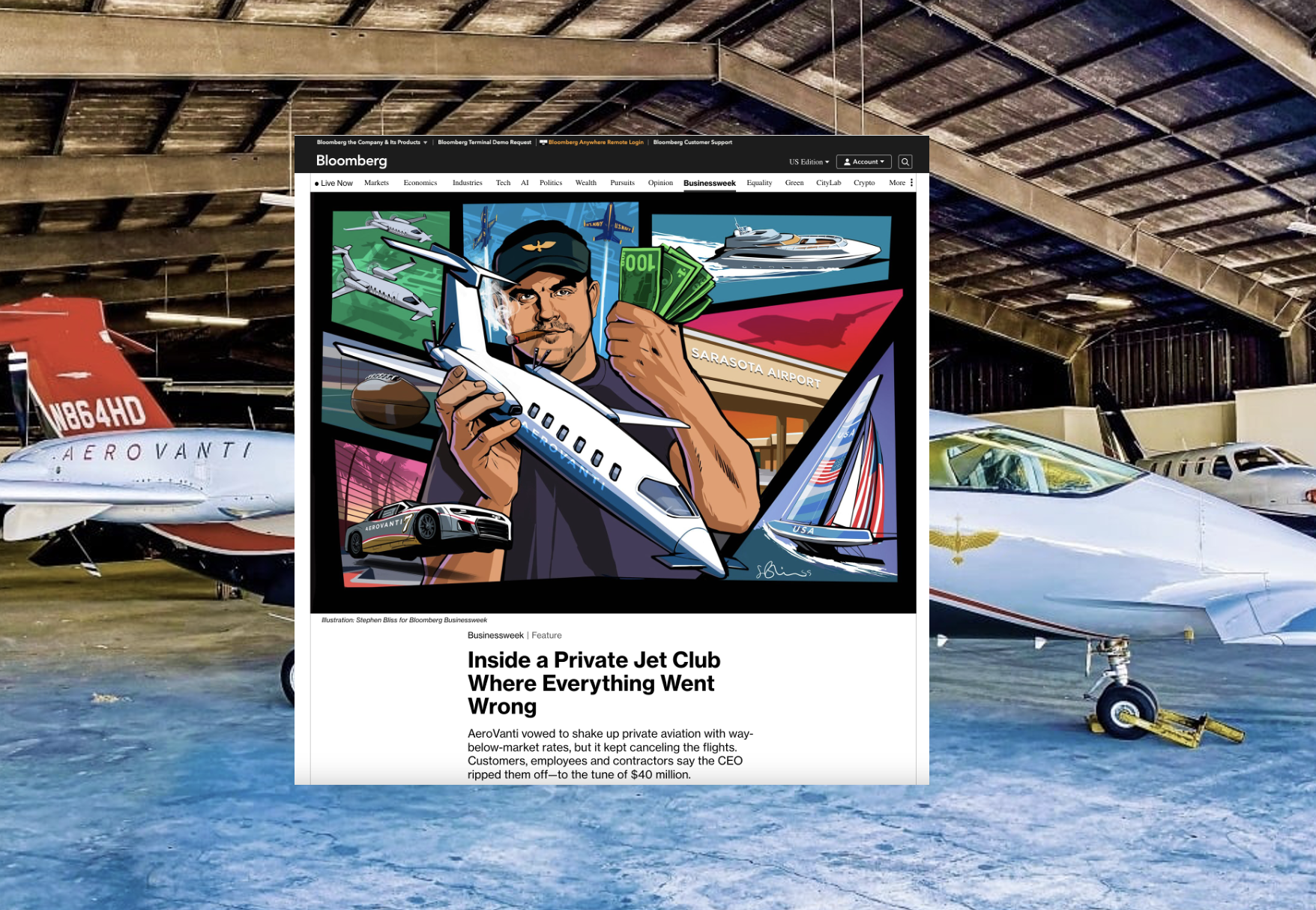

The report by Brett Crane describes the protagonist:

“Britton-Harr founded AeroVanti in his late 30s. Wide-shouldered and big-jawed with short-cropped hair and a beaming smile, he communicated with the quick, confident diction of a QVC host. Fluent in boardroom jargon, he could sound like an artificial intelligence program trained on corporate PowerPoints. He preferred fist-bumps to handshakes. Most often he came to work wearing shorts, flip-flops, a visor, dark aviators and a Rolex.”

It covers everything members know well, from start to lawsuits.

The initial pitch was that he started the company because his family found the perfect airplane in the Piaggio turboprop.

Addressing safety concerns was Britton-Harr’s father, a retired American Airlines pilot who was introduced as chief pilot.

There were disappointments as flights were canceled at the last minute.

At the same time, members saw Aerovanti signing expensive sponsorships with the Tampa Bay Buccaneers, Chicago Cubs, and other sporting interests.

It quotes the Aerovanti member Facebook group where one member wrote, “Bernie Madoff could learn a few things from these clowns.”

There was the launch of the $150,000 Top Gun membership.

The story also covers the strategy switch.

At its outset, Britton-Harr planned to outsource as much as possible.

He then pivoted to a vertical integration strategy.

It also covers the $100 million funding announcement, which Private Jet Card Comparisons later and exclusively reported was untrue.

The tale tracks where some of the money went – flying influencers and potential investors gratis and expensive caviar parties.

It also addresses how employees weren’t paid and how the company lied about how many airplanes it was flying.

Currently, Britton-Harr faces charges of fraud related to other companies he had started before Aerovanti.

Aerovanti wanted to be a more affordable version of Wheels Up.

In our initial coverage, we wrote, “Whether AeroVanti is the next Wheels Up, Avantair, or something else, it will be interesting to watch.”

You can read the full story here.

READ: Caveat Emptor: Avoiding private jet scams, bankruptcies, and shutdowns