NetJets may be ubiquitous with the concept of fractional ownership and by far the dominant player in the market, but the big question remains, in 2023, is the unit of Berkshire Hathaway worth a premium?

(Updated June 11, 2023) – There’s no question that NetJets is the biggest player in the private aviation sector, three times bigger than Directional Aviation’s Flexjet, the second-largest player. It’s also one of the most purchased programs by the over 3,000 subscribers to Private Jet Card Comparisons. And since I get to talk to you every day, it’s safe to say I have more day-in-day-out contact with private aviation consumers than any other journalist. And if there is one company that comes up more than others, it’s NetJets.

(Editor’s Note: For the most recent news about NetJets, visit our NetJets Hub Page.)

In 2022, NetJets and its aircraft management arm, Executive Jet Management, clocked 598,477 flight hours in North America. Flexjet, Inc. flew 183,548 hours.

It showed an increase of 52,000 flight hours from 2021 to 2022. Those numbers – NetJets’s year-to-year gain – would have ranked it as the sixth-largest operator.

The biggest player is getting bigger.

Berkshire Hathaway CEO Warren Buffett and Bill Gates posed for a NetJets ad in the early 2000s.

However, there are challenges as it seeks to grow its dominant position.

As we update this article in 2023, we also find NetJets is sold out of delivery slots until well into 2024.

It raises the question, is NetJets worth the wait? But first, let’s look at how the company got into such an enviable position.

NetJets currently has over 11,000 share, lease, and jet card clients worldwide, including more than 8,400 in the U.S. and nearly 3,000 in Europe.

Its clients range from Fortune 100 companies to owners of all sorts of successful businesses.

There are retirees who no longer have access to the company jet. Professionals in medicine, law, and finance use jet cards for personal and business travel.

Wealthy individuals buy jet cards for family members, such as enabling a daughter to regularly bring over their grandchildren.

The unit of Berkshire Hathaway sells fractional ownership (beginning at 50 hours per year and requiring a five-year commitment).

A typical Monday morning view of NetJets U.S. flying activity will see over 400 flights.

Leases start at 25 hours, although they contain more restricted access than 50-hour leases.

And after a hiatus of more than 18 months, NetJets is again selling jet cards to first-time customers.

Prior to suspending sales and renewals of jet cards in August of 2021, 20% of NetJets’ flying was attributed to jet card customers.

However, NetJets didn’t sell cards directly until 2010, when it bought Marquis Jet Partners, which was founded in 2001 to sell jet cards onto the NetJets fleet.

Jet cards are an important element of NetJets’ business.

They are useful to fractional owners who no longer need 50 hours of flight time per year or don’t want to make another five-year commitment.

The idea of having similar service points as fractional ownership (guaranteed availability, one-way pricing, fixed hourly rates), but without the long-term commitment, has sent them to look into jet cards.

According to NetJets officials, 50% of fractional customers start with jet cards, so they also provide a pipeline of shareowners.

NetJets often refers to itself as the gold standard – with pricing to match. Although, as you will see, there are a number of places NetJets can be a price leader.

But to the key question, is the price worth it? Can you get something similar and save money?

When I talk to subscribers from finance or procurement departments of big companies, particularly those that are publicly traded or advisors to UHNWs, NetJets is usually among their top choices.

The adage is you don’t get fired for buying IBM. In other words, if you recommended NetJets as the best solution to the chairman, even if there are issues, your recommendation would be defensible.

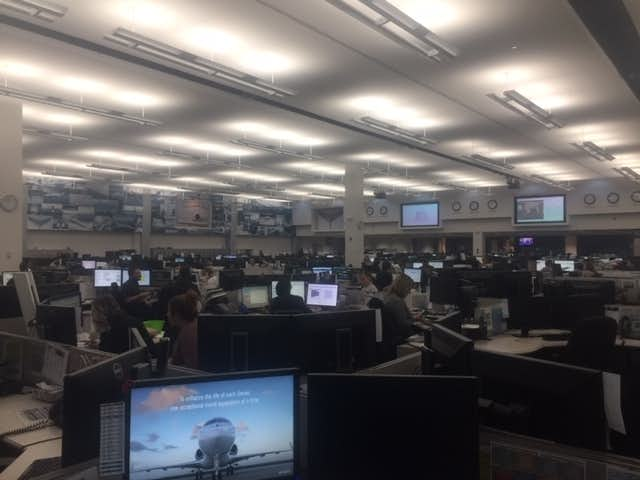

NetJets operations center in Columbus, Ohio, provides a good view of the company’s scale and focus on safety and service.

As a unit of Warren Buffett’s Berkshire Hathaway, NetJets has the iconic investor’s seal of approval. He’s even appeared in ads for NetJets – with Bill Gates about 15 years ago.

During the annual shareholder’s meeting in Omaha, which is literally a trade show of Berkshire companies, NetJets aircraft are often used as a backdrop for various cable television shows covering the event.

The second point of reassurance for risk-averse buyers is the company’s staying power.

In 2009, hit hard by the Great Recession, the Columbus, Ohio-based operator racked up a $711 million loss.

It’s something that would have probably been a death blow to many companies. With Berkshire’s backing, life went on.

The first Cessna Citation Longitude will join the NetJets fleet later this year. Above is a manufacturer-owned demo aircraft painted in the fractional operator’s color scheme.

In private aviation, new state-of-the-art aircraft alone don’t guarantee staying power.

Look up Zetta Jet. It left a 70-page long list of creditors, including those who had prepaid six figures for charter flights. Low prices are often too good to be true.

Look at Avantair. After the fractional share provider closed down, it was found to have falsified maintenance records during its money squeeze.

In May 2023, HondaJet fractional JetIt, which marketed $1,600 per hour flights, shuttered.

Big-name backers don’t necessarily help, either. JetBlue and Qatar Airways were investors when in 2020, JetSuite customers lost $50 million in unused flight credits.

During this year’s annual meeting, Buffett said, “(Wheels Up has) 12,600 people who have given them over a billion dollars on prepaid cards…and I think there’s a good chance some people are going to be disappointed later on.”

For many private flyers, the most important part of choosing a provider is the folks at the front of their airplane.

In addition to their twice-per-year five-day visits to Columbus, including four days of recurrent simulator training at Flight Safety, they also get service training. The head of the Owner Experience hails from Ritz-Carlton.

Sometimes it means saying no when the flight crew believes a decision could impact safe operations. “Our owners pay us a lot of money to tell them no,” says Don Wittke, the chief pilot.

Flight crews at NetJets average 16 years with the company and over 10,000 hours. Its attrition rate is under 5%, including retirements and extended leaves.

In 2018 it hired 185 new pilots who had an average of 6,500 flight hours.

NetJets says it plans to hire 850 new pilots in 2023.

“We’re not a steppingstone. We’re a destination,” says Alan Bobo, an operations executive. Some do go to major airlines, and less than 1/10th of 1% go to other business aviation companies. The message is NetJets gets the creme of the crop.

With over 2,900 pilots, NetJets allows pilots to take themselves off a flight for any reason without retribution. That includes being tired. Flight planning considers potential fatigue for pilots, analyzing where they have been flying, including crossing time zones. By plotting it out days in advance, operations can plan longer rest times for certain crews while scheduling well-rested crews to pick up a specific flight.

Pat Gallagher, the president of sales and marketing, says few charter operators have that as an option. The operator may only have several of that aircraft type, and the plane is in a far-flung destination. The only option is to delay the flight or fly with a legal but possibly tired cockpit.

In fact, it’s the relative lack of fatal accidents in private aviation that executives at NetJets believe provides a false sense of safety for both consumers and operators. An example often cited in the industry is the Bedford, Massachusetts crash that killed Philadelphia Inquirer co-owner Lewis Katz in May 2014. It was found the pilots did not run a single checklist between engine start and take off. In 98% of their previous 175 takeoffs, they neglected to do a flight control check.

NetJets pilots work seven days on, seven days off shifts. Pairings change constantly, something that the company believes discourages complacency from being too familiar with your flight deck partner.

After several years of acrimony between the pilots and management post-2008 Recession, new management has brought a new day to labor relations in 2015.

Increased flexibility, including now 200 bases in the U.S. alone, plus opportunities to earn more by flying more, had returned the esprit de corps, a critical part of the formula since, in private aviation, the pilots are the main conduit to the customer.

However, with mainline airlines offering up to 40% increases, pilots at NetJets are agitating for mid-contract increases.

In April 2023, the union, NJASAP, sued NetJets, alleging violations of labor law.

Right now, the unresolved chasm between the union and management is the biggest cloud hanging over what is otherwise a halcyon period for NetJets.

It’s the scale that helps power what executives say is an industry-leading approach to safety. NetJets is IS-BAO Stage 3 (as are others, such as Solairus Aviation, Jet Aviation, and Jet Linx Aviation) and Argus Platinum. It dropped Wyvern Wingman. Its viewpoint is that none of the third-party raters can provide the rigor of its internal safety focus. There are over 150 hours of pre-scheduled C-Suite meetings annually that focus on safety.

One example is FOQA, which stands for Flight Operations Quality Assurance. It takes flight data recorder data from every flight and then uses big data to slice and dice it. Among the thousands of data points, it tracks approaches to every airport, including where the airplane touched down on the runway and where it stopped.

Based on that data, NetJets has created its own approaches for several airports, including Truckee, California, and is doing so for a handful more, including Heber City, Utah, and Sedona, Arizona. It has also restricted operations of certain aircraft types to specific runways at some airports.

While passengers would never notice variances in landing and stopping points that led to the changes, that’s the point. Identifying minor operational variations that, combined with other factors, might at some point lead to something more serious. Eliminating them is the goal.

FOQA data is also used in simulator training, and data is used among pilot groups in ongoing competition based on optimizing safe flying practices. Instead of one pilot not wanting to critique another, the idea is teamwork and the knowledge that every move on the flight deck is recorded, so there is no way to hide mistakes or oversights.

When looking for a good French restaurant, you probably don’t have your assistant call three or four places to compare their price for Duck a l’Orange. And you probably don’t go back and ask if they can knock a few dollars off or add a free appetizer.

However, that is the way some people shop for private aviation solutions.

It’s also the typical way companies sell against NetJets.

In a way, they say, “We have cheaper duck, and duck with orange sauce is a duck with orange sauce.”

Calculating value isn’t straightforward, but NetJets doesn’t make it easy, either. To start, NetJets doesn’t publish its pricing like many other companies.

The hesitancy for NetJets in publishing a public rate card, for jet cards, or shares and leases, is that competitors will use it in presentations to show their price advantage.

Lots of jet card and charter companies do their own buyer’s guides.

They compare what they offer to others. I’m not sure if I’ve ever seen one that doesn’t tout the sponsor’s offerings as X% less than NetJets.

That said, NetJets is not always more expensive.

But it’s not just about price.

Executives at the flight provider like to say if you are going to pay 10 times more than first class, pay 12 times more and get the experience you are looking for.

One example of NetJets’ scale was a customer whose daughter was flying back home from South Dakota.

Her commercial flight was canceled, so Dad called NetJets. It had a repositioning flight in the area. From there, it was able to land and have the young lady on her way home in about an hour.

With over 550 aircraft in the U.S., along with Executive Jet Management and NetJets Europe, and over 900 business jets worldwide, the scale is a strength and part of the company’s value.

Poor recovery from mechanicals or other disruptions is one of the top reasons for wanting to change jet card providers.

NetJets has previously said the average recovery time is around two hours.

On June 14, 2021, NetJets suspended sales of its Classic Jet Card and Latitude in its jet card program.

The company said it was getting ahead of record demand as consumers flocked to private aviation to avoid Covid.

NetJets also changed the 45 peak days for its Elite Card to blackout dates.

It was the first of a number of moves.

In July 2021, NetJets paused jet card, fractional share, and lease sales for the Phenom 300 and Citation XLS.

It also announced plans to add 100 aircraft by the end of 2020.

On Aug. 23, 2021, NetJets suspended all jet card sales, creating a waitlist. That included renewing existing card clients.

On Aug. 23, EJM followed suit with its Ascend membership program.

As more airplanes arrived and the demand surge eased, NetJets opened up sales at the 25-hour level again.

In Spring 2022, NetJets began offering 25-hour leases in durations of 3 and 5 years as a jet card replacement.

In October of 2022, it reopened card sales to past customers.

The core of NetJets’ focus is fractional ownership – even if there are no delivery slots until well into 2024.

Fractional owners get callouts of as few as six hours and just 10 peak days for the year.

| Size | Aircraft |

| Light | Phenom 300 |

| Midsize | Praetor 500 |

| Super Midsize | Sovereign, Latitude, Longitude, Challenger 350 |

| Large | Challenger 650 |

| Ultra-Long-Haul | Global 5500, Global 6000, Global 8000 |

Right now, available deliveries for the Phenom 300s are estimated in October 2024.

The new Praetor 500s won’t begin arriving until 2025.

Finally, this spring, it started accepting new customers into its card program.

Still, the program has a number of restrictions, including a longer lead time to book and a month-and-a-half of blackout dates (see below).

| Policies | Classic Jet Card | Jet Card | Corporate Angel Card |

| Availability | On hold | Open for new customers | Open for new customers |

| Non-Peak Booking | 10 hours | 48 hours | 48 hours |

| Deicing Included | Yes | Yes | Yes |

| WiFi Included | Yes | Yes | Yes |

| Full Catering Included | Yes | Yes | Yes |

| Peak Days | 30 days | 45 days | 45 days |

| Blackout Dates | 0 days | 45 days | 45 days |

| Peak Day Surcharge | 0% | 0% | Varies |

| Denominations | 25 hours | 25 hours | 25 hours |

| 2023 25-Hour Jet Card Pricing | NA | $278,900 | $399,900 |

Currently, the Classic Card, which featured a 10-hour callout, is still suspended.

The basic jet card, previously called the Elite card, now has a 48-hour non-peak callout instead of 24 hours.

As of June 2023, the Phenom 300 jet card was priced at $11,156 per hour, including fuel and taxes.

In August 2019, NetJets added the Phenom 300 as an Elite Jet Card program. It was priced at $189,000 for 25 hours, including fuel and FET, and serves as its entry point.

The Phenom 300 was reduced to $168,900 in Spring 2020, and a Classic option was added.

For 2021, NetJets repriced its jet cards. The Phenom 300 Elite Card went to $7,516 per hour ($187,900 for 25 hours). The Classic version for the Embraer light jet is $8,836 per hour ($220,900 for 25 hours).

Both include Federal Excise Tax, and there were no fuel surcharges.

A subsequent rate hike in June 2021 pushed the price of the NetJets’ Phenom 300 Elite Card to $8,196 per hour ($204,900 for 25). At the same time, NetJets stopped selling its Classic Card.

As of Spring 2022, NetJets is offering 3-and-5-year leases at 25 hours per year as a jet card replacement while the program remains on hiatus. The NetJets Phenom 300 jet card equivalent costs $10,205 per hour, including lease and management fees, based on the current fuel variable.

It’s wrong, however, to believe NetJets is always more expensive.

NetJets actually may offer a lower price than other companies.

For example, its Red Cross-Country Corporate Angel Card gives the user flights a mission-appropriate super-midsize jet for segments over 3.5 hours.

Shorter flights are in a Citation Excel/XLS, a midsize jet. The flights are all the same hourly rate regardless of aircraft or duration.

Hawaii is in the primary service area, meaning no ferry fees, plus it comes with guaranteed availability. You can use all 25 hours for the super-midsize aircraft, too, making it a go-to solution if you are traveling to the islands.

There are other examples, as you will see.

If you are flying to Canada, the Caribbean, Mexico, or Central America (for the Excel and larger), there are no surcharges, just international fees. Other jet cards have surcharges of up to 50%. Some don’t even have one-way rates (no ferry fees) outside the Continental U.S. In other words, flying to these places might actually be cheaper with NetJets.

NetJets doesn’t have a peak day surcharge for its current 2023 jet cards.

While it’s not alone, surcharges can be up to 40%, although more typically 5% to 20%.

Still, if you are doing lots of peak day flying – something I recommend trying to avoid for several reasons – that higher NetJets hourly rate may actually be closer to your other quotes when you factor in extra charges from other providers.

Another area where NetJets pricing might turn out to be more favorable than other options is for flights under two hours. NetJets’ daily minimums are 60 minutes, including taxi time, except for the Phenom 300 and Excel/XLS. For those two, there is no minimum.

Quite a few providers have two-hour minimums on larger aircraft. While website rates often look great, they don’t necessarily match your invoice.

That midsize jet with a two-hour daily minimum at $8,500 per hour is going to cost you $17,000 at least for that 45-minute flight ($8,500 x 2 hours). NetJets will be about 40% less with its XLS.

Duck analogies aside, in addition to safety, one factor you need to take into consideration that can impact your actual cash out-of-pocket cost for flying is deicing.

If you are flying in winter weather, deicing can add up quickly – only about a quarter of the card programs we analyze, including NetJets, include deicing.

When you charter a jet, you pay for deicing, and if it had to be ferried in from another airport experiencing winter weather, you might find you get charged twice for your single flight.

For a large jet, you might find yourself paying an extra $5,000 to $10,000 for deicing before you even start your trip!

There are other places where NetJets saves you cash.

Primary Service Areas for its jet cards vary, but for the most part, they include the entire Caribbean, Central America, and Mexico. Competitors have surcharges ranging up to 50% for these same places.

Others only offer custom quotes, so you don’t get fixed rates. That means repositioning costs are factored into your quotes.

Before restarting jet card sales at the end of 2022, NetJets introduced 25-hour leases. Previously, leases, like fractional ownership, required 50 hours per year.

The leases run either three or five years.

They have a 24-hour callout.

As of June 2023, they have 10 annual blackout days, 35 peak days with a 25% surcharge, and 45 more peak days with no surcharge.

About 30% of NetJets customers get upgraded for operational reasons. What’s more, the upgrades are doled out based on fleet utilization. Jet card customers are granted operational upgrades on the same basis as owners. Subscribers who have shared their NetJets flying with me showed upgrade rates well over 50%.

NetJets has been investing in wide-ranging catering upgrades based on how taste changes at 45,000 feet altitude. At the same time, customer preferences are noted. However, making them happen sometimes is easier said than done. In one case, operations learned that there was no Amstel Light aboard an aircraft scheduled to take a customer who had it on his list of requirements. What’s worse, the brand wasn’t sold anywhere near the airport he was leaving. Luckily, there were several other NetJets aircraft parked there. They pooled their Amstel stock and split up the supply so the customer could pop his favorite cold one.

There are no extra charges for catering which is based on the number of people flying and flight time. There is an extensive menu, including local specialties. Owners can order via phone or online. Wines rotate on a quarterly basis. However, NetJets will allow you to order substitutes without additional charges. Having catering included probably won’t be the reason you choose NetJets. However, it does provide some savings over many programs.

Probably the best way to understand the investment of NetJets into its operations is to visit its headquarters in Columbus, Ohio. In a large room, similar to what you would find at a major global airline is the core of operations. It includes owner services, schedulers, dispatchers, and its own team of five meteorologists. They often talk directly with customers to discuss weather issues not directly related to flying. For example, “Is it going to rain there this weekend?” If so, why bother going if you can’t play golf?

It also helps the company plan for disruptions so that several days ahead of time, they can contact customers and recommend moving departures earlier, later, or at alternate airports. Nervous fliers are often happy to move flight times if it will mean avoiding bad weather flying.

The company believes the scale and depth of its fleet and operations really come to light when there are disruptions. There’s faster recovery. It can assist more customers faster when there are natural disasters, such as potential hurricanes, that necessitate customers evacuating themselves, their families or their employees.

In terms of its vendors, NetJets is constantly auditing and evaluating. That goes down to how FBOs store catering. Vendors that don’t pass muster are eliminated. Major maintenance is handled through approved and certified third parties are audited.

Popular aircraft types can stay in the fleet for up to 20 years. However, the average age is around 6.5 years.

The company also checks all aircraft when they flow through Teterboro and updates cabins as needed. That can range from a full refresh to replacing specific items such as tables or paneling.

I’ve heard from subscribers who say they have run across cabins in the Excel/XLS fleet they think could use a bit more TLC. I also spoke to another subscriber who is now looking to return. He said the quality of aircraft he was getting via on-demand charter was too hit-and-miss for his tastes.

Consistency is a benefit of NetJets. It configures its aircraft types (with the exception of the Challenger 650, which has a divan option) with seating arrangements. Unlike many jet card programs, you get a similar product from flight to flight.

On March 3, 2021, NetJets announced it had obtained 20 AS2 supersonic business jets’ purchase rights.

Aerion’s global order backlog was over $10 billion, with the order ahead of a planned 2023 production start. The speedy private jet will reach speeds of over 1,000 miles per hour, carrying 8 to 12 passengers.

However, in May 2021, Aerion suspended operations and shuttered.

In terms of its fleet, NetJets is constantly taking on new aircraft and exiting older ones.

During NBAA in October 2018, the CEO Adam Johnson said it had added 230 new jets over the previous four years.

At a conference in 2020, its president, Pat Gallagher, said the company expects to take delivery of at least 40 new private jets annually for the next decade.

In October 2021, NetJets said it would order up to 100 additional Phenom 300s.

In May 2023, NetJets struck a deal with Embraer that will bring as many as 250 of its Praetor 500s into the fleet.

NetJets’s 60th Bombardier Global arrived in June 2023.

Between 2022 and 2023, it expects to add 175 jets.